Import taxes are a big problem for those who buy in China. A lot of people don't know that and ends up being surprised by collection. The tax rate in Brazil is 60% of the total of merchandise, including the freight.

But not all orders are taxed by the IRS. Very commonly there is no charge and you receive the product in your home without the hassle. In this text you you won't find any way to receive your purchases without paying taxes, because it does not exist. Any order has chance to be taxed.

A big mistake is to think that orders up to $ $ are tax free in fact, the law exempts only cases where the sender and recipient are individuals, What is called “gift” postal package Declaration, IE, a gift sent by a person abroad for you here in Brazil.

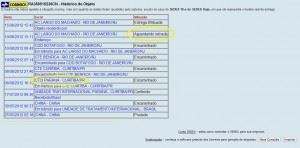

The figure below shows the Customs postal Declaration in any package sent from Hong Kong or China. Normally this is the tag (or printing), populated by Chinese site, the recipe is based on issuing the payment of taxes. Must be present the value of the goods (8 dollars in this case), the product (only suitable for “Electronics”) and weight (0.3Kg). Note that the field “Gift” It is not marked.

![IMG_20121026_020747[1]](http://www.tudovemdachina.com/wp-content/uploads/2012/09/IMG_20121026_0207471-300x290.jpg)

Only within the agency you will know the correct value to be paid. Of course you already imagine being anything close to 60% the price of goods, but the problem is that the Chinese websites always put an absurdly low value on the customs declaration form (first photo). Even in the case of tablets or phones often statement is nothing but 20 or 30 U.S. dollars, and if it does the recipe arbitrate a value more appropriate for the package and for the tax due.

What to do so if the tax charged is greater than the due. There are three possibilities: you pay anyway to receive logo merchandise, you refuse the package and he will return to the Chinese site (so you get your money back) or so you go in with a request for review.

I have to warn you that the review might result in an even higher value and still have to pay the tax with fine. Just do it at your own risk. To request review you will need to fill, at the post office, the form below:

In addition to the form, print the credit card showing the payment, the invoice (request) the Chinese site and own invoice PayPal. Also includes printing and page where the products are being sold (with price). Remember that the more information you have purchase the easier it will be to review and most likely reducing the tax due. Prepare the patient because the review process typically take almost two months, because it includes shipping the product back to the ICDC and back to your city.

The best thing to do is always thinking that the whole product has 60% of taxes. Make this account whenever you make an order in China. If the product is sold in Brazil for less 1,6 times its value in Chinese site buy here. The risk of being taxed there is always, especially in the case of large orders and heavy as tablets, mobiles and laptops. Good luck and happy shopping!

Everything comes from China products reviews site purchased in China

Everything comes from China products reviews site purchased in China

Good afternoon I'm about to make a purchase 5 cell by alibaba Chinese website will be taxed so? And what would be the tax amount that I would have to pay if taxed

Good morning!

Sellers of BANGGOOD where I made a purchase is considered as an individual?

and circulating on the Internet that there is a law where even products 100 dollars can not be taxed ,This is true?

Thank you!

Revenue does not consider NOTHING like individual, even if it was. Everything will be taxed if they want so. You can enter in justice, but it is not very easy…

Hello, I bought a blouse in aliexpress by 9.34 dollars and shows the record of the post office that the goods were not taxed in “In transit to RFB – Released without taxation / BR” but also it gave what went wrong and then forwarded pair agency waiting withdrawal. O prevailing? The fact of having gone to pick up at the local or the information that was not taxed?

Prevails what happens at the time of delivery. If you are taxed you have to pay to receive. Perhaps withdrawing the agency was given by address error and you will not be taxed. Who knows?

Hello, I am buying two watches on the site MiniInTheBox, freight and all of R $ 53,00, I am in the state of Alagoas, by my purchase, the likelihood of the product being taxed is high?

It should not be taxed not. Generally small orders are not taxed. is for, must be less than 100 actual taxes.

Good night folks!

Fortress. Ceará. Brazil.

I'm planning to buy a smartphone on the site Banggood, between two models, a cost $99 ZTE and other $135 Doogee. I want to know if I ask to reduce the invoice value of 99 for 55 and the 135 for 75 U.S. dollars, will I be taxed on 60 ℅ fact, but still get a good smartphone for a nice price, it via registered airmail.

The site is good?

Customs will let it go?

If you don't pass, OK, paid the 60 ℅ “still happy”

Not to say the brand and sim common, help this reduction?

Could I ask both for $55 ?? So pay less.

The Banggood site is reliable. They post fast and support when something goes wrong. About asking to register lower price, won't work. Here in the recipe they see the phone on the x-ray by the size and charge a fixed value (usually less than what you paid for). So don't worry about it and choose the best phone for you.

Good morning my brother, Thank you!

Bought Doogee Y6 Piano Black. I asked day 10/01/17 and arrived in Brazil in Curitiba day 07/02/17 and it has been forwarded to my town, Fortress. But I have not received. 45 days. And it sure was taxed at a 200 real. But let's wait to get.

Good luck!

Hello good afternoon, I'm looking to buy a Chinese suit worth 43.94 dollars on aliexpress. Question and what the value of the tax will I pay. Here in Brazil's Parana State. City of Campina grande do Sul-pr neighborhood jd. paulista

Taxes are 60% on the value of the product plus shipping. If the value of the product is wrong, or the recipe did not find consistent with the product, will be refereed a value. So, buy a good suit and more expensive, because the tax is likely to be the same. Then tell me what happened…

to, Good night.

I'm about to receive a gift (cell phone) from South Africa, my brother will send to me by DHL.

I'm going to be taxed?

Thanks.

Yes, quite possibly. Even if you are indicated under 50 dollars and the sender is an individual.

in which part of the invoice they make the product description? I can ask them to describe the product in Portuguese and facilitate the work of customs? I want to buy a piece of glass and saw the list of products allowed that only if it's glass accessory for the kitchen/home… It turns out that what I bought doesn't fit in that purpose, but can fit if you want to use that way, so I wanted to ask them to describe how a product like a candlestick kkk, and ai?

You can usually ask for the Chinese shop (or Ebay) to put anything in writing “Customs Description”, a label that exists in any order. When putting in Portuguese, It makes no difference. When to put something “different”, will be crap, because they will see on the x-ray and will only delay the taxation. I don't think they will block your order, But anyway good luck…

Good morning, I'm qrendo to buy a bike group q costs U $ $ 520, is my first purchase on aliexpress, the seller sends me $ 35.00 value and how this, This is a good alternative? or probably if not hopefully be taxed.

It does not help the seller declare 35 U.S. dollars, because in this case the recipe will arbitrate the value. If they think much this 520 dollars will then be charged on this same value.

I bought a cell phone and ordered by DHL. Arriving in Brazil, DHL found the shopkeeper in China didn't declare my CPF on consignment. No one from DHL contacted me to get this information, I would report on a good. I had to call at DHL, Open a protocol for that DHL send an email to them at the airport, for that, then Yes, They include my CPF on consignment. Now run the risk of my order to return because it is up to the customs tax free or not, because the consignment should come from China with my CPF. But nobody in China warned me about it and how it's the first time I buy, I didn't ask to be put through ignorance. I called the airport customs and customs explained that it is the duty of DHL check appears in the my CPF or not. No one saw and were still preparing my package to return to China. Had to run to ask to inform my CPF. Now I'm waiting. DHL said the chance of the package back to China is 99%. Worse is that I contacted the shop and they said I'm going to have to bear the costs of re-entry of the order in the country, the rate of them there. What do you mean???

EWw! I never asked anything by DHL, but really gives information on the CPF, that sometimes is asked here in Brazil and always when the package is DHL. However, at least I know there's no re-entry rates in china. I've sent two mobile phones back and haven't paid a thing. Next time send by normal order that is far less annoying, Although time consuming.

Hello, did some shopping on the site Wishcom where I found ridiculously cheap prices. But,the first shipment that arrived from a dress, I was charged 24 of revenue and 12 postal rate. The dress cost 40 real and didn't understand the value, mail employee either knew explain, just tell that everything coming from China is charged. I bought several items with value below 50 real and I'm getting a little angry

You will be charged 60% the values of the goods (and freight) more 12 postal rate. Even if the package has smaller value of 50 U.S. dollars.

The fact is that there is a law that sets in $ 100 exemption, How is a federal xdecreto, hierarchically a gatehouse, resolution repealed, so taxing it is arbitrariness of the IRS, Depending on the circumstances and amounts involved ... fit an action in federal court. in so-called JECs .

That's a huge dump, but it's true. Who knows in the future that doesn't work out…

Hello I am needing to buy a battery for my phone which costs R$ 25,80 in the DX.

Will it be charging?

There is no table or criteria for the imposition of tariffs on imported products?

grateful

Jorge

There is no discretion. You will be charged 60% the value that is in the package more 12 real postal rate. Try to buy a cheaper battery, who knows on Ebay. If the package is small you may not be charged anything…

Hello I bought camera Sj5000 plus aliexpress $ 158 dollar was taxed on the value R$ 550,00. If I refuse to pay goes in the mail back to the sender?. What I do for a seller to get back, have any tips

If you refuse to pay, the packet back to the sender. Send an email to the store that you will do this. Wait back and continue tracking with the same code. When I get back they will return at least some of the money.

Hello I made a purchase on aliexpress and the order was for the matter easy will charge 250 I mposto what acomtece if I leave the package back to the aliexpress?

Hello I bought camera Sj5000 plus aliexpress $ 158 dollar was taxed on the value R$ 550,00. If I refuse to pay goes in the mail back to the sender?. What I do for a seller to get back, have any tips

If you keep order tracking by tracking code. When you get to the sender you get money back, or a part. Send an email to the seller that it will occur.

Hello I'm going to buy a guitar pedal in banggood costs $ 394R would like to know if I'm going to be Taxed because I always bought on the site whish.com and I have never been taxed and this site and secure? And you guys have any tips to help me p n be taxed..

If will be taxed depends on luck, the size of the package and the value declared on the outside of the package. The tax is 60% the value declared in the package and 12 real to the post office.

I made a purchase in the amount of 110 real, I was taxed on 580 already with the 12 the post office, I'm not going to review because I think the Government really want to raise more than ever. I have to go in with some paper in the mail ? Or just leave it alone ? And how does Aliexpress ,the value has already been paid.

Does the review. Has nothing to do with the Government, these mistakes happen for decades. It was a mistake… If you print the product page, the invoice and the Bill or invoice of the card showing the correct price they lower to the right value. Otherwise, hopes to go back to China and ask for the money back to the seller.

Thanks for the clarification! Thanks

I wonder if I opitar to leave the merchandise back was taxed there not paid and returned the product they can negatively impact my name if I don't pay the fee

Not legally. The import tax is paid at the time of nationalization (receipt) of the product. If you choose not to receive, There is no reason to tax. There is also no cpf in order to enroll the person in some kind of denial of debt…

I'm buying a flash by aliexpress for US $49.99 = $ 161,48, There is a possibility to get out more expensive, If you are taxed, When should be?

All products can be taxed. The rate, collected by revenue and pay when you get the package at the post office, is 60% on the value of the product. Generally the IRS estimates the value of the product well below the value that we pay, but there is even a chance to be greater, and in this case one can make tax review.

OLA,, you could give a hint,

want to buy 2 tires for my bike, saw advertisement of china and the total value and 12 U.S. dollars,

how it works

do I have to pay the freight + rates here in Brazil.

You will pay the freight to match with the seller on the site. Send a message or email to the site and ask, If you don't spin the freight value clear. When you get to Brazil, If you're branded, taxation should be around 60% the value of the product. It may be more, If there is error in taxation, but it is usually less.

If you are taxed will receive a telegram to go to an agency receives the product and pay the tax. Otherwise the product will arrive right in your home.

good night I want to know something I bought a cell for free over the internet for free I will pay for the cell Yes or no

Yes. Even free product may be taxed on 60% the estimated value for the recipe.

Hello , ATTENTION a gang is acting on the internet with the Web site GLAZEINFO.com . Are a gang that offer products Apples and more stuff at prices of 400, 500 real . THEY DO NOT SEND ! do you pay the freight charge + rates or you pay for everything and DO NOT SEND.

the site of the gang is : glazeinfo.com

They say suppliers from china and NOT SEND AFTER YOU PAY .

Federal Police and Internet crimes Division on their tail .

Terrible! I still prefer the Chinese sites like Dealextreme and Banggood…

Hello good afternoon! I am looking to buy a wedding dress for a website of china by the value of +/- R $ 300,00, I'm just afraid of the rate to be twice the value of the dress

I I urgently need a help please.

So I want to buy an Original cell of china which has not yet been released in Brazil. His price is 300 $ The total almost 1000 real more or less.

The delivery comes through Singapore Post. I'm from SC

The question is ... What is the possibility of being charged? And if I be charged how can be this value?

Thank you and I count on help of vcs

Should be charged Yes. Of the more than 30 cell phones I've ever bought in China, only one of them was not taxed. It is very likely. However, possibly you will not be charged in 300 U.S. dollars, because generally they estimate the value down. I usually pay 100 to 200 real in my rates when you buy cell phones.

Good afternoon,

Walked in recently with a request for review, Since I was taxed much above 60%. I bought a product that cost me $ 64,51 America to me with the amount of R $ 158,00 + 12,00. If you don't correct the value, How should I proceed?

If not correct you will have to pay to receive or give up and go back to China, and the seller must return the money. But if you put right the purchase order, printing the page where sells the product and the amount paid in the making on the card I think they won't go over to the correct value.

know the procedure to import a power generator on Aliexpress , and what aliquato of tax or if the same ex-tariffs

Check the matter easy Post Office. There are limits to direct import, to the matter easy of posts and different if person or entity.

Hello, How does receive by DHL ? the seller mentions that pays for shipping , but there is also taxes 60 % ? and as my city DHL makes no direct delivery , through the post office . How do I pay the tax if the seller does not roll back to him . If I don't get in my city ? att Rafael

I know the process is the same. But as I have never used the service, I'm not sure. In DHL's page they say they pay taxes and then send the invoice. I find it kind of weird…

The big carriers pay all taxes and airport charges to streamline the process and then charge you.

DHL usually send email asking if everything is OK before you deliver your product (and the Bill with your account). The UPS sends the product and direct ticket for you. It really is a huge gain in productivity.

Hello, I enjoyed your explanations, but I'm having a problem with DHL, my order 3 watches was barred by prescription and asked for the notes and vouchers etc…

After I received a collection of 4 x the value declared! including fines etc.. not worth the cost products 289 dollars and are charging $ 1890,00 of taxes! If you do not pay the product will be returned to the sender ? Usgobuy is a redirector of orders, I can post again? who will cope with prejudice!?

I thank you.

You can stop paying Yes, and the product back to the recipient that should return the money to you. You can also ask for a form at the post office to make tax review (http://www.tudovemdachina.com/wp-content/uploads/2012/09/form_pedido_revisao.jpg), also sending the payment order, impression of the site where you purchased the product, charging the card and anything else that proves the correct price.

I bought a mini camera for $ $ $ 20,00 that is $ 50,00 and been taxed in almost R $ 100,00 more $ 12,00 for an additional fee that is total cost $ 160,00, While a camera that costs on average here 70,00 or 80,00 real, so I ended up returning the package and I'll see if I get at least part of the amount paid.

Our, What a terrible! With me only once happened taxation above the correct value. I did review of value! There is a form that fills and I even took copies of the credit card and the product page proving the correct price. It took a couple of months, but taxed properly…

Hello! I intend to buy a machine for ali express but I'm too scared, because it's too expensive (some R $ 10.000,00) and I don't know if it would be delivered, or how much would be the taxation. Here in Brazil it costs around 30.000,00, but I'm unsure. Could you pass me some guidance?

I thank you,

Kenya

Until 500 dollars you can use the direct import, just buy and hold. Until 3000 dollars you should use the service matter easy Post Office. See the site of the post office. After 3000 dollars have to check specific legislation on prescription. http://www4.receita.fazenda.gov.br/simulador/BuscaNCM.jsp

Thanks for your help! And on the safety of purchase, because first I'm going to pay to receive, I'm going to buy by aliexpress, is there any risk? I've read about “buyer protection” but I'm still in doubt.

The AliExpress works kinda like Ebay, each product has a seller and a reputation. Check the seller's reputation. I don't know how does the buyer protection, but PayPal has a to return the money if the product does not arrive…

There's always some risk. Not to get, doesn't work. Must take all these factors into consideration.

I have a package that is more than 1 month stop in Curitiba, According to the postal tracking. This is normal?

Is Yes. Could be more… until a couple of months…

whenever the product stay waiting for the Agency to be fetched mean will be taxed?

Yes, If the product has to be sought in the Agency probably means it was taxed. There is also the possibility of a problem in the delivery of the product and that's why you have to get at the Agency, but it is more likely to be paid any tax…

Goods coming from china that is still toast at a cost of UR $ 9.89, was retained in the post office and are taxing me a value of R $ 98,97 real,a tip there,or quiet retreat? This is going to hurt me in other goods to reach ?

Is there a way to do a review of taxes. Go to the post office with the completed form below to make a new analysis. Nothing will harm you if you do review or leave the parcel as lost. See more info here:

http://bjc.uol.com.br/2012/01/05/como-solicitar-reviso-de-imposto-de-importao/

Since the beginning of June, In addition to high taxes on products, the consumer had to pay R $ 12 to be able to remove the package from the post office.

Other costs. In addition to the amount already paid by the freight, the customer must pay amount corresponding to the tax on credit Operations, Foreign Exchange and Insurance, that focuses on the credit or debit card, of 6,38%, the import tax of 60%, applied also on the value of freight, and GST, Depending on the State in which it is.

Source: http://blogs.estadao.com.br/no-azul/2014/07/01/mercadorias-importadas-compradas-pela-internet-ganham-uma-nova-taxa-de-r-12-dos-correios/

I've paid for these 12 real and don't care about that. I just want my orders received within a minimum term and with respect. For me, that was good.

our that I think a theft 60% of fee, my god that Brazil needs to change, you have to have a rate and a fair price in this country, that is what else is in world.

Good morning Guys,

I would like to consult you about a problem I am having in a buyout of china.

I made a purchase of a cell phone on the site Pandawill.com. I've started going through anger when it took over 10 days to post the package (After I researched and saw that they didn't have stock so they send). At the time of purchase I chose to pay 2 dollars for shipping via Singapore Post because I've never been taxed buying with this type of freight, including already bought other cell phones and reached all ok.

To my surprise the Pandawill.com sent the tracking code from Germany and via DHL, I was P. of life because I heard about it via DHL a chance to be taxed is very high and also a product from Germany I believe it to be understood as more expensive for the recipe and consequently I pay tax more expensive.

As expected I product is taxed, is in the mail waiting for tax document, I believe it will be a high value because the phone cost 239 U.S. dollars. Now my doubt is as follows.

If I don't remove the product (If the value of the tax don't make it count) He returns to the sender or is the IRS stopped and I lose my money? From what I've seen in the text of this article he goes back to the site, but it's always like that with all kinds of freight? Has anyone had this experience with shipping via DHL?

I've opened a dispute on paypal because they have changed the shipping for them, but I don't know if I will get compensation. I believe that if the product is returned to sender would be easier to get my money back. Now one thing is certain, don't buy on Pandawill never, I've had to cancel a purchase once because it took them more than 20 days to post and now I had patience to wait for them to make these changes on your own.

Since already thank you very much.

Sorry to bring bad news, but any import rate, same due to a format change of freight, It's really for your account. So ends the PayPal dispute, Unfortunately.

If you do not want the package and pick it up, He will return to china and will not need to pay the tax. Upon receiving the merchandise the store will charge you anything and you will send part of the payment back. Maybe not worth it…

Better luck next time!

Gee, I think dirty, because it gave the option to choose the shipping should not have changed. Or send an email diplomatic if I would want to send another form or cancel the request.

This situation has happened to you too?

From now only buy on AliExpress and DHGate.

It was a mistake for them, but you can't do nothing. Unfortunately…